From Consensus to Contrarian

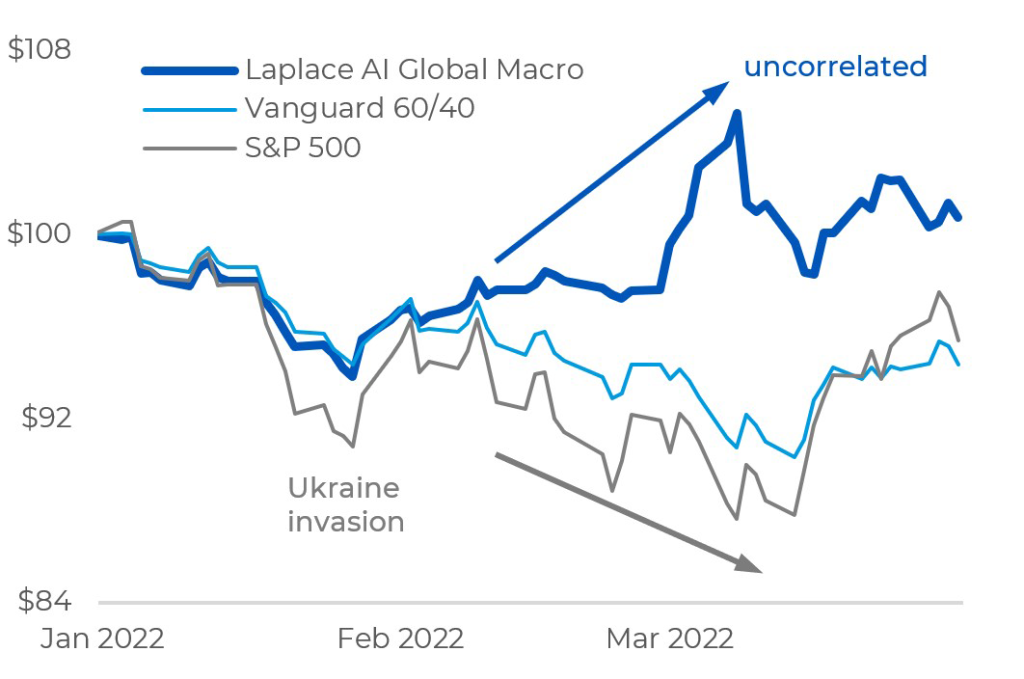

The markets delivered a challenging first quarter for all investors—as often happens, what was working stopped working. 2021 wasn’t without its own (mostly inflationary) worries, but they were largely based around a broad consensus view of a booming economy pushing the S&P 500 upward. Our AI platform, PSIMON, shared that consensus, at least within its tactical global macro strategy: it delivered similar returns to the S&P 500, but through some savvy AI, was able to deliver the lower volatility associated with a cautious 60/40 portfolio, as per its mandate.

Bold Moves

In January, things changed quickly, as threats of war loomed alongside surging inflation. The consensus quickly broke down, leaving most investors in a fog, unsure what where to move next. Commodities—oil, particularly—spiked, but perhaps too high, too quickly, and soon retracing some of its gains.

In the midst of the geopolitical turmoil, journalistic noise and market uncertainty, PSIMON acted quickly and decisively, radically reallocating its portfolio at the end of January. In just over a month, the portfolio went from a 44% exposure to the S&P500 down to 2%. Moreover, after spending most of 2021 correctly preferring real estate over gold as an inflation hedge, PSIMON (correctly) reversed that strategy with a strong move into gold.

By the end of a tumultuous February, it had made some more adjustments—mostly defensive, dampening volatility—by selling emerging markets, and establishing some US dollar exposure. By the end of March, PSIMON had chosen to exit the S&P 500 entirely, take profits from its commodity and gold positions, while continuing to seek some safety and stability in the US dollar.

Tactical Ain’t Easy

Unsurprisingly, after a 2021 where our tactical global macro portfolio was strongly correlated with a soaring S&P 500, it quickly became negatively correlated with a falling S&P 500.

In doing so, PSIMON accomplished a couple of remarkable things:

- Unlike most machine learning tools, it was able to act quickly to a rapidly changing data landscape, thanks to our unique approach to recognizing and navigating regime change.

- Unlike most human investors, it was able to completely re-shape its portfolio—quickly and strategically—driven neither by panic nor held back by stubborn beliefs.

The significance of this can’t be understated: we shouldn’t expect typical AI solutions to respond quickly in difficult-to-predict or never-seen-before market conditions. And that’s the challenge for today’s AI solutions: to add value and gain the trust of investment managers, it must outperform not just in stable markets but especially in times of uncertainty and rapid change. PSIMON was able to outperform its 60/40 benchmark by 6.93% over the quarter, as well as beating the S&P 500 by 5.89%.

As PSIMON’s designers, we’re excited to see that our unique approach proved itself once again in a difficult market. We’ve designed the platform to:

- recognize regime change, whether fast or slow,

- and then pick the right tools (forecasting methods) for the new environment

Our rigorous back-testing has shown great performance and limited drawdowns in both the 2008 global financial crisis and it outperformed again during the 2020 v-shaped COVID crash. Early 2022 has thrown investors a different set of challenges and we’re thrilled to see PSIMON navigate quickly and decisively once again.