Use PSIMON’s

predictive insights

to put your clients in the right assets, at the right time.

This detailed monthly outlook covers (i) a global macro strategy and (ii) a low-volatility ESG strategy, including allocation updates to each model portfolio, which are built from established, low-cost ETFs.

Strategies

Easy-to-execute, client-friendly strategies: use PSIMON’s predictive allocations to re-balance monthly for outperformance, using common, low‑cost ETFs

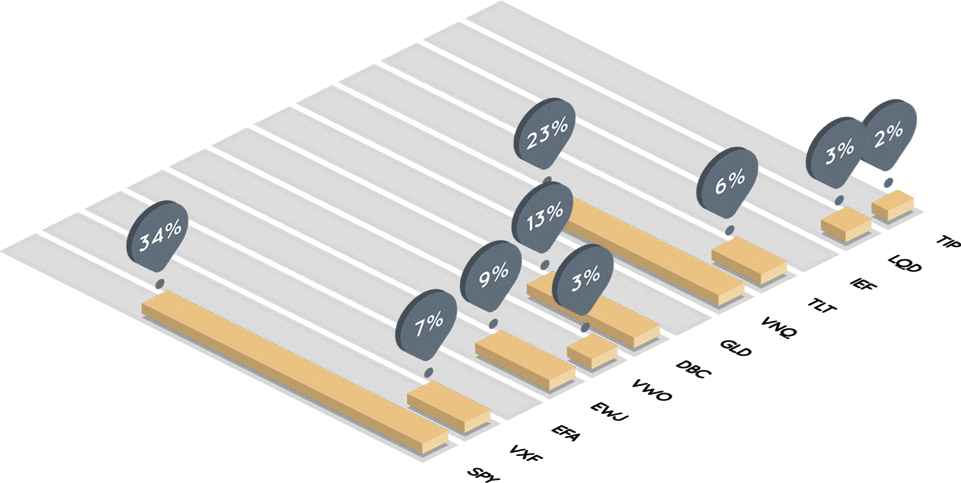

Dynamic Global Macro

Covering a broad set of major asset classes, including fixed income, with monthly re-balancing and managed volatility

Low-Volatility ESG

Built from a strategic selection of ESG-rated ETFs, give your clients a portfolio designed to outperform a traditional 60/40 portfolio

Features

Efficient:

designed for more impact, in fewer trades

Assess relative attractiveness across sectors and asset classes

Detailed asset allocation recommendations, updated monthly

Predictive market calls: identify opportunities and threats early

Thoughtful analysis gives context to PSIMON’s data‑driven output

More actionable strategies for portfolio managers, coming soon

Using PSIMON in Your Practice

Some portfolio managers use PSIMON’s analysis to compare to their own, leveraging PSIMON’s insights to adjust their strategy; others follow PSIMON’s Columbus & ESG portfolios more closely, keeping their clients’ core portfolio allocations in line with PSIMON’s.

Either way, PSIMON is here to help you dynamically allocate, with confidence and simplicity. PSIMON understands what portfolio managers—and their clients—need: consistent outperformance without undue risk, in as few trades as possible, and free from the emotional biases that lead to poor returns.

Discover PSIMON: Institutional-Grade AI, Built for Portfolio Managers

We built PSIMON to democratize portfolio AI, giving advisors access to sophisticated AI used by the world’s most elite hedge funds and institutions. PSIMON is the product of over 6 years of development, working with top academic researchers, data-science labs, software engineers and financial experts.