PSIMON SAID: 2021 Portfolio Review Edition

Laplace Insights’ portfolio AI platform — PSIMON — delivered smart, risk-adjusted returns in 2021 as it navigated shifting markets with predictive insight and agility.

January: the short-lived Value – Growth reversal

2021 began with growth stocks where they’d been for a long time: dominant, and ignoring all the value gurus, forever predicting that growth stocks were overpriced and poised to fall.

It makes sense: those growth stocks included tech companies making the COVID-triggered Work-from-Home revolution a reality.

And while some investors could and did argue that the low price of value stocks represented an opportunity for long-term investors, there was no obvious evidence that value was ready to outperform growth.

However, PSIMON compares the present market data to a vast library of financial events to find similarities. A clear example of “knowledge is power” (or, in this case, “knowledge is returns”).

Investors who listened to what PSIMON SAID were rewarded with a few months of solid outperformance from value stocks.

What made this one of PSIMON’s best calls in 2021 is that not only did its AI identify when to move into value stocks, but — to close the loop — it also identified when to sell (July), as growth stocks re-established their dominance over value.

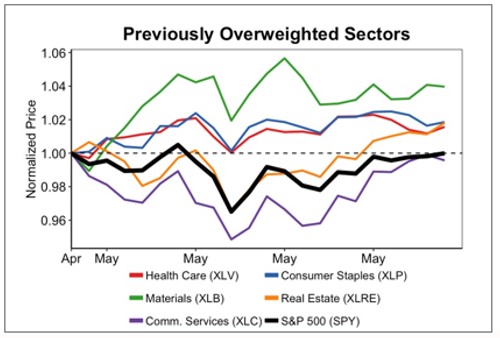

April : the new ‘big 5’ sectors

Every month, PSIMON shares its view on sector attractiveness in our monthly Outlook.

Last April, PSIMON recommended to overweight 5 sectors in particular: materials, health care, consumer staples, real estate, and communication services.

While not a perfect bullseye — communications performed in line with the S&P 500 — the other four meaningly outperformed in the following weeks.

It’s a good reminder that PSIMON is not a magical, infallible fortune teller; but rather, a data-driven, probabilistic forecaster.

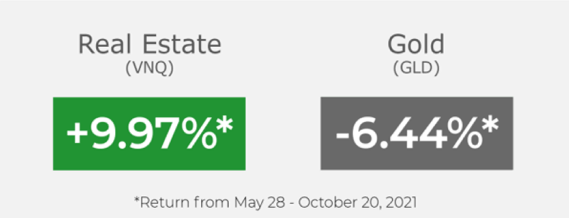

May: real estate is the new gold

The pandemic period was a true “gold rush for inflation hedges”.

Back in May, in order to protect itself, PSIMON made another interesting call: investing aggressively in real estate instead of the golden child of inflation fighters, gold.

It wasn’t just for May, PSIMON kept a strong stance on real estate all the way to October. The result speaks for itself.

A key element of PSIMON’s AI is that while it learns from the past, it can easily choose to ignore tradition, and make calls that might surprise us.

October : Energy’s second wind

PSIMON hit a bullseye again in October, identifying early momentum in the energy sector before many investors.

By the end of the month, XLE (our preferred energy sector ETF) nearly doubled the S&P 500’s return.

November: predicting a greener future

PSIMON’s predictive AI can be employed across multiple strategies. Most of the calls above have applied to our global macro portfolio, “Columbus”, which we cover in our monthly outlook. In November was added our new AI-powered ESG strategy.

PSIMON not only adapts to the market, but also to the people.

As more and more investors look to invest in a more responsible way, our team worked on a new tool that allowed just that… without sacrificing returns.

PSIMON was designed from the ground-up to be adaptable to different strategies and different investment goals. Beyond the addition of an ESG strategy, PSIMON will keep evolving to answer to investors’ needs.

The (data) science of looking lucky

Could the prescient investment calls in this article have been accomplished by keen and insightful observers of the market? Maybe. But statistically unlikely.

Among many unfair advantages, PSIMON has speed on its side.

By the time that organic, human-powered research would have reached the same conclusions, the markets would have already been moving on. While there’s still some truth left to the adage that “you can’t time the market”, PSIMON was built to help portfolio managers be in the right assets, at the right time.