PSIMON Says: Tricky Markets, Simple Shifts

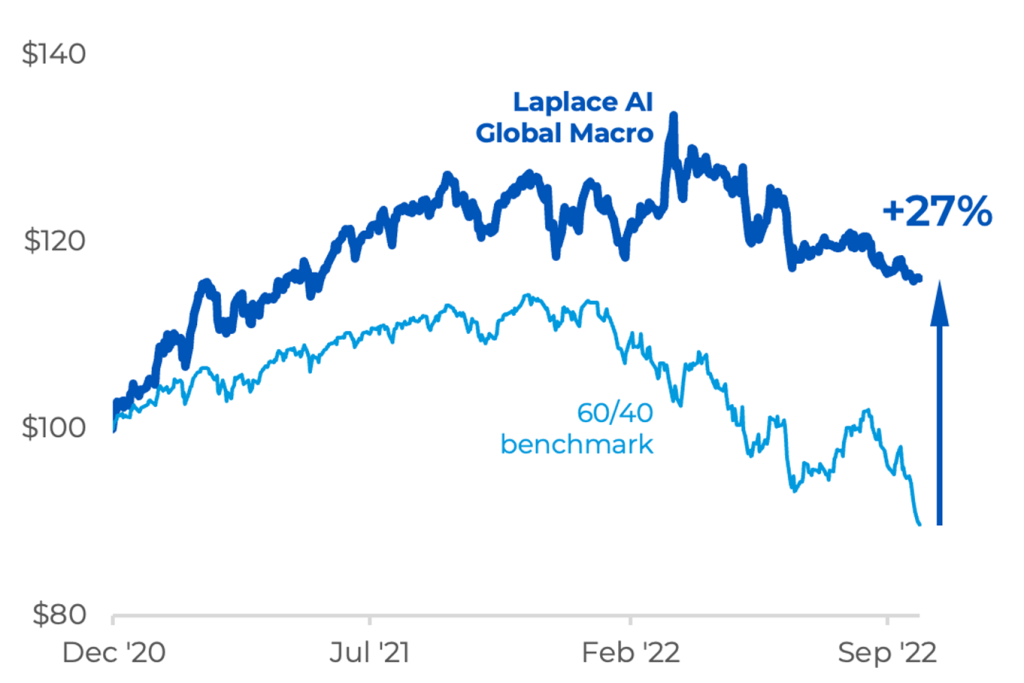

Our AI-driven Global Macro portfolio has continued to steadily outperform its 60/40 benchmark by a 24.3% difference, despite its simple construction (built from 15 long-only vanilla ETFs), and limited, once-a-month adjustments. Since going live in 2020, our portfolio is almost up 14%, while its benchmark has lost over 10% (and almost identical risk/volatility).

PSIMON, our ground-breaking AI engine, pays keen attention to shifting market conditions. In 2021, it made the most of market tailwinds and kept pace with the S&P500. 2022 has been a different story, and PSIMON’s unique approach has proven itself nimble, quickly pivoting and adjusting to inflationary pressures and geopolitical uncertainty.

Looking back, PSIMON spent much of 2021 making timely adjustments to the portfolio’s real estate, commodities and S&P 500 exposures. In 2022, it’s been a different story so far: dramatically reduced exposure to stocks, and aggressive, timely moves into gold (January – April) and the US dollar (since June).

The portfolio’s outperformance continues to validate PSIMON’s unique machine learning approach, focused on recognizing shifting markets and regime changes, ensuring investors are in the right assets, at the right time. This innovative approach is outperforming other machine-learning and traditional quant tools, and can be readily applied and configured to our clients’ unique investment strategies and portfolios.

Reach out to Guillaume Choinière to learn more about partnership opportunities.